JMG Partner Success Guide

Welcome to the JMG partner success guide. This guide will help you understand the fundamentals of being a referral agent with the Jason Mitchell Group. Here you will learn about our lending, closing service, and referral partnerships.

We will discuss who they are and what they mean to us along with best practices with our referrals and referral partners. This page is your #1 spot for this type of training and review.

Additionally, all of the information you are about to learn is critical to the success of a JMG agent and deep-rooted into our culture. You will learn ISIMs, sayings that our team stands for and believes in. Sayings that you may, in fact, have already heard.

So please take your time and review each section thoroughly. From the 6 Pillars of Success to our Preferred Closing Services, so that there is no stone left unturned!

6 Pillars of Success

The key elements for excelling as a JMG referral agent

The 6 Pillars of Success covers the Most important aspects of being a JMG Referral Agent. These pillars are essentially the Referral Agents Creed. In the slides to the right we will go over The following topics and what they mean to us.

- Communication

- Every Client Every Time

- Coverage and Capacity

- Understanding the Programs

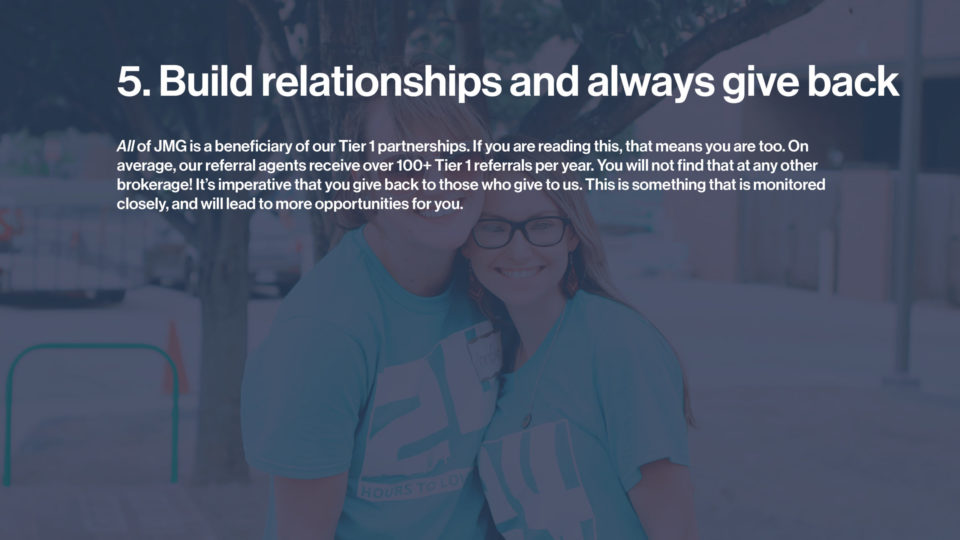

- Building Relationships & Give Back

- Honor & Protecting the Source

Click to expand!

Tier 1 Partnerships

Exclusive referral partnerships

If you are selected to be a part of a “Tier 1” Partnership, you have been selected to join the best and most exclusive partnerships we have. The Closing Ratio for this class of referrals can vary between 20% – 60% on average and depending on the partnership. It is required that you maintain a minimum of 20% average ratio to maintain on distribution.

These referral partners are considered to be “Tier 1” for a handful of different reasons. To name a few that are weighted when labeling them, please see below.

- Closing Ratio

- AVG 20+ Closings per Month

- National Partnership

Additionally, you may see an additional setup or unique training outside of JMG Network Certification to join these as these are exclusive networks. These partners traditionally have outside portals that will be needed to set up, to update clients & coordinators.

Home Advantage is a buyer & sellers program of CU Realty®, with a network of agents in all 50 states. CU Realty is among the pioneers of online real estate. Founded in 2001, they were one of the first companies to offer searchable property listings through the internet. And they were the first company to package that service along with an agent network and a cash-back benefit exclusively for credit unions. Their goal is to help members save time and money on their real estate transactions, while building more business for their credit union clients.

Home Advantage best practices

It is important to mention to the client that you just received their information from our partners at “the credit union listed” for our Home Advantage Program and that you are the real estate professional that will be taking care of them. It is also important you bring up the Banker associated with this referral and become their best advocate. When you complete the call, it is required to then reach out to the banker and update them on the outcome of your initial phone call. Please be sure to additionally read the notes on these referrals, as in some cases the banker will request you reach out to them first before you contact the client.

Client Incentive

All Referrals Save Big when they work through HomeAdvantage! These clients will qualify to earn Cash Rewards at closing. These savings are based on 20% of the total gross commissions, and will be applied towards closings costs or pre-paids.

Home advantage

Home Advantage is the platform/program, CU Realty provides their clients with. This program provides each member with exclusive benefits and savings when buying or selling their home.

All Referrals Save Big when they work through HomeAdvantage®, they qualify to earn Cash Rewards at closing. This incentive is a FULL 20% of the Gross Commissions put towards their closing costs. This program gives back an average of $1,500 per transaction nationwide. Their credit union can decide if it will apply the savings towards their closing costs or take it as cash.

Referral fee

The Referral fee for this partnership 40%. Reason being the incentive of 20% that will be provided to the client at closing

Tiered saving structure

| Home Purchase Price | Savings Total Example |

|---|---|

| $200,000 | $1,200 |

| $500,000 | $3000 |

| $700,000 | $4,200 |

Agentaccess (lead–updating portal)

Homeadvantage portal

MyHomeAdvatange Portal is the online client management tool that all of the CU Realty network partners use to submit, accept and manage referrals. When a referral is available for you, you will get a notification from this portal, where you will have the ability to accept or decline the referral. When the referral is accepted, you will be provided their contact information and client notes.

From the time you receive a referral until the time your client closes, this will also be your communication center to stay connected with CU Realty and all your client referrals. Best practice is to update within 6 hours of lead acceptance, weekly on Thursday & milestone updates.

Portal Login: https://www.mycuhomeadvantage.com/

Lead voyager

Lead Voyager is the online client management tool that all of the CU Realty network partners use to submit, accept and manage referrals. From the time you receive a referral until the time your client closes, Lead Voyager will be your communication center to stay connected with CU Realty and all your client referrals. Best practice is to update within 24 hours of lead acceptance, and weekly with milestone updates.

Portal Login: https://auth.brytecore.com/login

New American Funding (NAF) is one of the top lending parters of JMG. New American Funding Loan Officers will pre qualify a client and confirm that they are in need of an agent. Once they commit to speaking with an agent, NAF Loan Officers will then send the client to RE HOME CONNECT (The Network). From there, an REO Home Connect representative will reinforce the benefits of working with an trusted real estate partner in the network and discuss the incentive that the client will receive by working with you, the agent, and the loan officer at New American Funding.

New American Funding best practices

It is important to mention to the client that you just received their information from our partners at New American Funding and that you are the real estate professional that will be taking care of them.

All Referrals Save Big when they work through RE Home Connect, they qualify to earn Cash Rewards at closing. These savings are based on the purchase price of the home and applied as a lender credit at closing.

RE Home Connect (The Network)

RE Home Connect is a sister company of New American Funding. They (RE Home Connect) connects New American Funding pre-approved buyers from all across the U.S. with Preferred Agents in their local market. They find out the specifics around what the buyer is looking for in a home, and the exact area they are looking to purchase in. Once RE Home Connect has all the details, they will match the pre-approved buyer with our Agency (JMG) who will distribute to a specific agent in the local market through CAMP & NAF’s online client management tool, AgentAccess.

Referral Fee

Referral fees for this partnership can vary between 30%-35%. Anything under 100k is 30% & over is 35%. You can find the referral fee in the referral agreement that is given to you from ReHomeConnect & on your JMG Lead Alert Email.

Tiered saving structure

| Home Purchase Price | Lender Credit |

|---|---|

| $125,000 - $200,000 | $750 |

| $200,001 - $300,000 | $1,000 |

| $300,001 - $400,000 | $2,000 |

| $400,001 - Or more | $2,500 |

AgentAccess (Lead–updating portal)

AgentAccess is the online client management tool that all of NAF’s network partners use to accept and manage referrals. From the time you receive a referral until the time your client closes, AgentAccess will be your communication center to stay connected with New American Funding and all your client referrals.

Portal Link: https://agentaccess.rehomeconnect.com/login

Portal Training Video

Rocket Homes is a sister company of Quicken Loans®, with a network of agents in all 50 states.Quicken Loans is the largest lender in America, and has won numerous awards for their amazing client satisfaction. Every day, thousands of clients come to Quicken Loans to be pre-approved to buy a home. Many of these clients are in need of a great agent – that’s where the partnership between Quicken Loans and Rocket Homes begins.

Quicken Loans x Rocket Homes best practices

It is important to mention to the client that you just received their information from our partners at Quicken Loans, Rocket Homes and that you are the real estate professional that will be taking care of them.

Incentives

The PowerPack incentive is ONLY available for clients who are actively being serviced by Quicken Loans, meaning, they already have a loan being serviced by QL. If your client is eligible for this they will have an accumulative savings up to 2% when they buy and SELL. They will receive ½ a percent back on the sale of their home, ½ a percent when they buy a home & 1% closing credit on their new mortgage.

Rocket Homes

Rocket Homes connects Quicken Loans pre-approved buyers from all across the U.S. with Preferred Agents in their local market. They find out the specifics around what the buyer is looking for in a home, and the exact area they are looking to purchase in. Once Rocket has all the details, they will match the pre-approved buyer with our Agency (JMG) who will distribute to a specific agent in the local market through CAMP & Rocket’s online client management tool, Client Central.

Tiered saving structure

| Buy, Sell & Finance | Savings Total Example |

|---|---|

| $300,000 Loan Amount w/ 20% Down Paymet |

$2,400 |

| $300,000 Purchase Price | $1,500 |

| $250,000 Home Sale | $1,250 |

Client Central

Client Central is the online client management tool that all of Rocket’s network partners use to submit, accept and manage referrals. From the time you receive a referral until the time your client closes, Client Central will be your communication center to stay connected with Rocket Homes and all your client referrals.

Portal training video

Seller Call Script

Veterans United Home Loans is a full service mortgage lender headquartered in Columbia, Missouri. The company has 28 offices nationwide and is licensed in all 50 states. The company primarily originates VA loans, a mortgage product guaranteed by the U.S. Department of Veterans Affairs. In 2018, Veterans United financed $10.44 billion in VA volume nationwide, making it the largest VA lender in the nation.

Veterans United best practices

It is important to mention to the client that you just received their information from our partners at Veterans United and that you are the real estate professional that will be taking care of them.

Client Incentive

All Referrals save big when they work through Veterans United but they will save even more if they get their financing through Veterans United Home Loans! These clients will qualify to earn Cash Rewards at closing. These savings are based on the purchase price of the home and applied as a lender credit at closing.

2 week rule

- Every 2 weeks you must re-login to Agent Dash to have successful “Claim Rate”

- If you have not received a referral in 2 weeks or more please reach out to our Account Executive, Hannah Snitker.

Veterans United Realty

Veterans United connects their pre-approved buyers from all across the U.S. with Preferred Agents in their local market. They find out the specifics around what the buyer is looking for in a home, and the exact area they are looking to purchase in. At this point, the client is made aware of specific benefits and savings that they will receive for working with VU and their preferred real estate agents. These savings can range from $100 to $1,875 depending on the purchase price .

Once they have all the details, they will match the pre-approved buyer with our Agency (JMG) who will distribute to a specific agent in the local market through CAMP & Veterans United’s online client management tool, Agent Dash.

referral fee

The Referral fee for this partnership 35% regardless of what is listed in the agreement from VU.

Tiered saving structure

Home Purchase Price |

Lender Credit Minimum vs Maximum with VUHL |

|---|---|

| Up to $249,999 | $500 |

| $250,000 - $299,999 | $250 - $625 |

| $300,000 - 399,999 | $500 - $750 |

| $400,000 - $499,999 | $750 - $1000 |

| $500,000 - $749,999 | $1000 - $1250 |

| $750,000 - Or more | $1875 |

Agentaccess (lead–updating portal)

Agent Dash is the online client management tool that all of the Veterans United network partners use to submit, accept and manage referrals. From the time you receive a referral until the time your client closes, Agent Dash Will be your communication center to stay connected with Veterans United and all your client referrals. Best practice is to update within 24hrs of lead acceptance, and weekly with milestone updates.

Portal Login: https://app.myagentdash.com/login

Veterans United portal training

Tier 2 Partnerships

Additional Referral Partnerships

- About

- Agent Pronto

- Consumer Direct & CET

- Homebird

- Home Buyer Connection

- Home Captain

- My Credit Guy

- Opcity

- Referral Exchange

- Urban Bound

- Xome

- Opendoor

- Sold.com

- AAA – Moxie

- Ideal Agent

- Zillow Flex

A Tier 2 Partner Referral is just as important to JMG as a Tier 1 partnership. The real difference between these Tier 1 and 2 is primarily being Abundance of Referrals or if these relationships/programs are nationwide. Tier 2 partners should be treated with the same urgency as a Tier 1.

These referrals tend to have a lower closing ratio, however, this is solely based on partnership and program as some Tier 2 partners, close at a 50+% but may not have the abundance of referrals that a Tier 1 has.

Agent Pronto is JMG’s referral partner who connects home buyers and sellers with our top real estate agents. Home buyers and sellers sign up for our service so they can be matched with the perfect agent for them. Immediately after signing up, Agent Pronto gets connected to the client to answer any questions they have and verify as much of their information as possible. These referrals may not come in initially pre-qualified but have in fact showed intent to go through the financing process if needed. Agent Pronto referrals have an avg closing rate of 22% marketplaces may vary.

Agent Pronto has an online client management tool that all of JMG Agents utilize to manage their referrals. From the time you receive a referral until the time your client closes, this will be your communication center to keep Agent Pronto up to speed with the status of your referrals.

When a referral is available, JMG operations will choose an agent to distribute the referral to. This is generally based on marketplace geo & current lead flow.

Referral Fee

Referral fees can range from 25 – 35% and are not dictated by price point.

Agentaccess (lead–updating portal)

Portal Link: https://agentpronto.com/app

Username & password will be provided by JMG Operations upon referral assignment.

Portal training video

JMG has a team of Loan Officers with various Banks who call on Leads who are interested in obtaining a home loan. When these LOs are speaking to these clients they are asking if they are working with a real estate agent, if they are not, they will then pitch JMG and our Real Estate Rewards program. From here, the loan officer sends the referral to JMG Operations for distribution.

Important aspects of the initial call

A very important aspect to these referrals is to become the lenders best advocate, we need to be sure we are honoring the source with these and protecting our lender that originated these leads the best we can. Additionally, staging in constant communication with them as the journey progresses with the client.

Incentives

This client is incentivized by receiving Real Estate Rewards, which gives them 30% of the real estate commissions earned and / or 1% off the listing commissions when they sell. This is a critical component to your initial call, be sure to bring this up.

Current partners working with JMG

- Axos Bank

- Cardinal Financial Corporate

- Cardinal Financial (Robert Coomer Team)

- Cardinal Financial (Ralph DiBugnara Team)

- Celebrity Home Loans

- Fairway Mortgage (John Conklin Team)

Client experience team

JMG Client Experience team also will call on these mortgage leads for our lenders, acting as their call center. These front end leads are typically pulled form Zillow Long Form or Lending Tree. When our CET speaks to these leads they are pitching our Real Estate Rewards program to them and if interested, sending them to our lenders for pre-qualification and distributing to JMG. Distribution can be done via live transfer or a phone appointment scheduled by the client to speak to an agent.

Referral Fee

Technically there is no referral fee on these, the referral fee is the incentive (30% of agent commissions) we are providing the client. It is CRITICAL when we get a contract accepted these incentives are facilitated by closing services and lender.

How will I receive these referrals?

These referrals are distributed from JMG Operations. Since these are also JMG Lending Partners, we try to match these pre-qualified referrals with agents who are giving back to these partners the most. The closing ratio on these are at 50% because of the incentive given to the client and familiarity between partner and JMG.

Real estate referral company with a national network of pre-screened real estate agents in every major metro. Homebird works with direct customers and those referred from lending partners to provide a real estate agent for listing or purchasing a home; matched on multiple factors and designed for the best possible experience and most successful transaction.

Before a referral is sent to our agents It is confirmed twice that they (client) is looking for your assistance. It is verified that each client referred either has been pre-qualified with a lender or is looking to begin the pre-qualification process.

It is critical that we pay attention to the active lender on this file through distribution and/or through the NEST application. Just like any other partner, we must honor the source of these referrals and make sure we do all we can to keep the client with the originating lender.

Portal training video

Homebird Nest

Homebird Nest is the online client management tool that all of JMG Agents utilize to submit, accept and manage Homebird referrals. From the time you receive a referral until the time your client closes, Homebird Nest will be your communication center to stay connected with the lenders and client coordinators throughout the process. This is an application that you should download on your phone through the play store or apple app store.

Referral Fee

Referral fees can range from 30- 40% and are not dictated by price point.

How agents are chosen

When a referral is available, JMG operations will choose an agent to distribute the referral to. This is generally based on marketplace geo & current lead flow. It is at this time where JMG Operations will also be setting up your portal in Nest if you have not already done so.

Agentaccess (lead–updating portal)

Portal Link: https://www.homebird.com/login

Username & password will be provided by JMG Operations upon referral assignment.

Home Buyers Connection is a 3rd party network that handles the distribution for lenders to connect them with a trusted real estate partner (JMG). The biggest partner you will see with this network is New Day USA, one of the largest Veteran home loan companies in the USA. Keep in mind that there is a high chance that the client you will be working with is a veteran so remember to ask and thank them for their service

Best practices

It is very important to mention the connection with New Day USA on the initial call. “We just received your information from Home Buyers Connection / New Day USA” and that you are the real estate professional that will be taking care of them. Must connect the dots from the lender and loan officer… “it looks like you are working with Joe Smith at New Day USA, that’s great! They are amazing.”

No incentives for this program.

New day in the USA

A loan officer at New Day USA had just pre-qualified the client and sent them to HomeBuyer Connections so the client can get into the trusted hands of a real estate partner, you. MUST BE SURE TO MENTION NEW DAY USA ON THE INITIAL CALL and foreshadow the experience they will receive from working with them and you, their trusted real estate partner.

Agentaccess (lead–updating portal)

HBC has an online portal which houses all of your referrals, with lender and referrer information. You will be given access to and instruction on this portal upon initial lead acceptance. Best practice is to update within 24 hours of lead acceptance, and weekly with milestone updates.

Portal Link: https://www.homebuyerconnections.com/login

Home captain is a 3rd party distribution network of which works with a variety of lenders throughout the country to facilitate their pre-qualified clients into the hands of trusted agents. Just like Quicken Loans has Rocket Homes, Home Captain is the Rocket Homes for these lenders. The goal is to put our best practices around these referrals and identify that YOU will be the agent they are working with and that whatever lender that is attached to the file is mentioned along and they will have a seamless experience throughout the process. Home Captain is the network where the clients are sent to from these banks to utilize the agent partners to assist those lending clients. JMG is a partner of that referral network.

Best practices

Because Home Captain works with a variety of lenders we need to cross reference that you just received their information from Home Captain and (Name of Lender). You will be the real estate professional that will be taking care of them. Make the client feel good about that lender and loan officer they are working with that they will be having a seamless and top notch experience

As of right now there are no current incentives tied to the Home Captain referrals.

Agentaccess (lead–updating portal)

Best practice is to update within 24hrs of lead acceptance, and weekly with milestone updates. Updates may be sent directly to the referrer which sent the initial lead alert and the lender on the file.

My Credit Guy is a national credit repair company that specializes in serving national lenders to enhance their clients' score in order to become eligible to purchase a home once their credit has been improved to a score in which they can qualify to purchase.

MCG services all 50 states and qualifies around 1000 borrowers a month.

How the program works

Once MCG receives a new client who has agreed to go through the credit repair process, they will send that client to JMG Mission Control. From there JMG Corp, will set the expectation that we will be matching them with a JMG agent who will be their Real Estate Professional showing and assisting them with their purchase once they have enhanced their score and approved by the lender to purchase.

JMG Mission Control will pitch our rewards program to the client and get them set up with a search portal. From there, we will then connect the new client to our JMG agent who will make their 1 st initial outreach which is simply an introduction call where they will build rapport with the client and discuss the program. It will be important that the JMG agent cross reference My Credit Guy as our partner and mention the lender that they are working with and the seamless process and incentives waiting for them once they can move forward on a home purchase.

Once the client has achieved a score which allows them to qualify for a home purchase (this could be a month, or it could be 6 months depending on the amount of work needed). MCG will send an alert to JMG Mission Control that said client is now ready to start viewing properties and making offers. At this point JMG-MC will re-engage with the initial assigned agent to let them know to reach back out to the client to begin the home search and offering process.

The JMG agent will then contact the client to say congratulations on now being able to purchase their new home, pitch the incentive and lender once again and begin their home shopping process.

Mission Control Actions

JMG Mission Control will take the initial intake call when MCG alerts us that there is a new client that is going through the credit repair process. JMG-MC will make the initial call to the client to discuss our program, set them up on a search and make the introduction to the agent that will be working with them in their local market.

JMG -MC will receive the, “qualified” alert from MCG that the client has now achieved a score which qualifies them to be able to purchase a home. From there JMG-MC will reach back out to the client to congratulate them and let the client know that we will communicate the “good news” to our JMG agent and that they will be reaching back out to get their showings started.

JMG-MC will then reconnect the client with the JMG agent assigned to the file to give them the green light that they are approved to start shopping

Agent Actions

JMG-MC will send the client to the JMG agent once the first initial call has been made. The agent’s responsibility will be to call the new client and introduce themselves as the agent who will be assisting them with showings once the time is right and their credit is to a point where they qualify to purchase. It is also important on this call to cross reference My Credit Guy and the lender associated with the file as ensuring the lenders have a high capture ratio is critical. Agent will also discuss the incentive that the client will receive though the “My Credit, My Rewards” program. The client will have already received a search portal of homes from JMG-MC, so they can begin to gauge the market for homes in their price home. Therefore, agent should reference that they should have already received this link. IMPORTANT TO NOTE: This initial agent to client call is an introduction call setting expectations and discussing the program. On this initial call the client will not yet be approved to begin their home shopping process, however, they need to know that you, JMG agent will be the once assisting them when the time is right.

JMG-MC will receive the official “qualified to purchase” alert, which will then trigger a call from our JMG-MC team to say congratulations on now being qualified to purchase. From there JMG-MC will send the client back to the JMG agent letting them know that they are good to go and to reach back out to the client to begin their home shopping process.

Any client who enters the credit repair process with My Credit Guy and takes advantage of the “My Credit, My Rewards” Program is eligible for a cash rewards at closing. This amount is equal to ONE HALF OF A PERCENT OF THE PURCHASE PRICE. It is important that the JMG Agent mention this on the initial call and the re-connect call and equate this to dollars based on the estimated purchase price. This amount will be a credit from the JMG agent commissions on the settlement statement once they close on a future property.

Every client that comes though the “My Credit, My Rewards” program was initiated by a lender partner of My Credit Guy. These lenders trust that when MCG connects them to a trusted agent partner that the agent partner will protect the lender and do everything possible to ensure that the client, when the time is right to purchase, closes with that lender and that loan officer. It is important that the JMG agent cross reference the lender and the LO on the initial reach out call and discuss that the rewards they receive are eligible when the purchase a home with them and close with the lender that is associated with that file. Protecting the lending source is vital to the success of the program and ensures that lenders and loan officers see that due to the high closing rate because of the program they will continue to send more and more clients through.

Summary

Opcity purchases millions of real estate leads from around the web, primarily from Realtor.com. They will call, filter, and continually follow up with inquiries until the perfect client is ready to speak to you.

How do I receive a referral from Opcity?

All client introductions to agents occur via a live warm phone transfer. The first agent to respond to our mobile alert will receive a real-time introduction to a ready client.

What can I do to be more likely to receive a better-qualified referral?

All JMG Agents must update their account settings to better qualify their referrals. This can be done by updating your price points to Only 150k and above, NOT accepting rentals, and creating a coverage radius of no less than 25miles. You can find all of this in the account settings, in the Opcity Application.

Additionally, Opcity Agent Matching Technology connects the right client to the right agent with the highest performance score. Your Opcity score is based on a number of metrics. The most important is the following.

- Closing Ratio

- How often you update your referrals

- Your average acceptance rate of referral

These referrals more than likely will not come in with a lender associated with the file. It is imperative that we are taking these referrals and sending them to our preferred lender if and when they need financing. This metric is looked at and overseen by JMG Operations. Due to these referrals not coming in pre-qualified, our expected conversion ratios are at 10%.

Are my clients incentivized to work with me?

Yes! Opcity referrals are incentivized via a cash reward for working with you. These rewards are based on a tier of the purchase price and vary between $600 – $12,000 (this payout is .3% of the purchase price). This is only applicable to clients who purchase at $150k +.

Important aspects of the initial call

When these referrals are accepted, a phone call will come inbound to you directly with the client on the line. When you receive these referrals, it’s important that we have a professional intro and do our best to get a showing scheduled on the phone. Also, these referrals more than likely will not come in with a lender associated with them. It is imperative that we are talking to the client about financing, we let them know about our preferred lenders as they will save money working with them and us because of our relationships. Due to these referrals not coming in pre-qualified, our expected conversion ratios are at 10%.

Client Incentive

Referral fees for this partnership can vary between 38%-30%. The fee can be found on distribution and referral agreement. This fee is based on purchase price 150k+ is 38% any thing below is 30%

Lead Updating

Download the Application Here https://mobile.opcity.com/

Summary

ReferralExchange is a partner of TopAgentsRanked.com, an online, free consumer-direct service that connects home buyers and sellers with local, top-performing real estate professionals.

Referrals from this partner can come in 2 different ways.

- A consumer-direct model, from TopAgentsRanked.com. This type of referral comes from this website, a consumer is directed here from the web via Google, Facebook, Instagram with a CTA for getting paired with a top agent to assist with their real estate needs. When they fill out the form to get connected, Referral Exchange is notified to reach out and certify the client as a real buyer who is, in fact, asking to be paired with a Real Estate Agent. Once they confirm this, Referral Exchange pairs the client with 3 agents for their choosing.

- Referrals from Outside Brokerages. Referral Exchange is also utilized for other brokerages as a place to send their clients if they cannot service them for reasons such as the client is looking to purchase or sell out of their coverage/state.

Important aspects of the initial call

JMG Client Experience Team

Every referral you receive from Referral Exchange will be called and confirmed a 2nd time by our JMG Client Experience Team. This is another attempt to better qualify the lead for you before you speak to them. Once our CET speaks to the client and confirms their Real Estate needs, we will attempt to warm transfer the call to you or set a phone call appointment on your behalf.

Client Incentive

Referral fees for this partnership can vary between 20%-35%. The fee can be found on distribution and within the referral exchange portal. There is no factor in determining the fee as these are set by the referring agent or Referral Exchange.

Summary

Urban Bound is a relocation company that works with a variety of organizations to help facilitate their move. Companies look to Urban Bound to handle all aspects of relocation for a client including real estate services. Urban Bound will be the connection from the client to JMG. Oftentimes the client will already have a relationship with a lender, if they need a referral we will send them to QL.

Lead types

Buyers and Sellers – Most of the time the person will be selling in one market and buying in another of which we may or may not be able to service. In these cases where we can service both areas we will let you know what JMG agent is working with the client in the other market

Important aspects of the initial call

It is important to cross-reference that the client was sent to you via our partners at Urban Bound. Our team is the preferred national real estate partner of Urban Bound and that you are the real estate professional that will be taking care of them. Be sure to also mention any incentive that they will be receiving.

Incentives

The client typically will have a reward for working with you that is based on the purchase or sales price of the property. Because the incentives change by the company referring to Urban Bound, we will make our agents aware of any incentives offered when we distribute the referral to our agents.

Referral Fee

Referral fees for this partnership are 38.5%.

Lead Updating

The best practice is to update within 24hrs of lead acceptance, and weekly with milestone updates. Updates may be sent directly to Bob Burns (referrer: bburns@urbanbound.com) at Urban Bound.

Xome is the 3rd party network for a variety of lenders, mostly Mr. Cooper. Mr. Cooper is the countries largest provider of servicing of mortgages in the nation. Xome, like Rocket Homes, is the network he turns to for the distribution network to get their clients in the hands of trusted agents.

It is important to mention that you received their information from Xome and because they are a preferred client, that they have some great rewards coming their way by working with you. Be sure to mention what the rewards are and that you are the agent who will be taking care of them.

Depending on the program the client qualifies for, will depend on the incentive that they will receive from working with you, the preferred agent on their transaction.

Referral fee

Referral fees for this partnership are 35%. *If the listing is done at 1.5% the Company/Agent split will be calculated at 75% to Agent 25% to Company to compensate for lower commissions.

Tiered saving structure

| Leadsource/Program | Total Fee | Agent Breakdown | Referral Payout |

|---|---|---|---|

| Super Seller | 5% total premium(paid by Buyer) | 2% Listing Agent 2% Buyer Broker |

1% to Xome |

| Purchase Pro | 4.5% total listing fee (commissions set and paid by seller) |

2% Listing Agent 2.5% buyer broker (buyer side pays referral fee) |

.5% paid to Xome (35% referral fee, 15% to client) |

| Premium Agent | 5% total fee to client | 2.5% listing agent | 35% of listing |

Lead types

The lead type within the Xome network can vary. While the majority of the clients will be sellers and while most of those will be REO properties that the bank (Mr. Cooper) has taken back some clients may be retail buyers as well. We will highlight this on the distribution to you. Some properties may be BANK OWNED properties. Some will simply be sellers that are looking to sell, in which they are incentivized by working with you. Buyer’s will be highlighted in which they are rewarded for working with you as well. There are three main programs:

- Xome – Super Seller

- Xome – Purchase Pro

- Xome – Premium Agent

(Each of these has specific discounts and savings to the consumer which we will highlight when the referral is sent)

As a partner of Opendoor our job as JMG is to facilitate a transaction. This can be done in two ways:

1. The consumer agrees to an Opendoor cash offer.

2. The consumer agrees that the Opendoor offer is not suitable OR Opendoor is not willing to purchase their home.

Because of this we have divided the opportunities into 2 segments:

1. OD Denials

2. OD Decision Calls

Opendoor Best Practices

OD Denials

When you receive an Opendoor denial referral, this means that

Opendoor has refused to make an offer on a consumer’s home. In these cases, OD will pass along the opportunity for us to be introduced as their preferred real estate partner to assist in a retail listing for their home.

The goal with these referrals is to explain to the client that although OD was not able to purchase, we as their preferred real estate team would like to offer our 21 day guarantee program. This is explained in our listing package that we will explain and send to the client. The bullet points of the program are as follows:

– We guarantee to sell their home within 21 days

– Client will receive a 1% listing discount. (2.5 and 2.5) for a total of 5%

– Our award-winning marketing package

– Full service support for a top real estate professional. You

– JMG Real Estate Rewards when if purchasing

The goal of offering the 21 days allows the consumer to have a comfort level that we

have a guarantee that we will not only provide a discount on the listing, saving them

thousands, we will also spend the money to promote and market their home with only a 21 days contract. Should the home not sell, the consumer will have the right to cancel with us at any time.

It is important that our agents under the pitch when you receive a denial listing referral from Opendoor which you can find here.

It is also VERY IMPORTANT that the client understand that in addition to this great listing discount, if they will be purchasing a new property, they are also rewarded. For those that sign with us on the 21-day guarantee program and purchase a new home, they will be rewarded with 30% of the real estate commissions on the buy side as well, putting thousands of more dollars back in their pocket at closing.

Decision Calls

An Opendoor decision call assigned means that there is a consumer who will be presented and Opendoor offer on their home. When you receive this particular lead source, Opendoor will provide all necessary assets from: Home specifics, photos, tour and anything pertinent to give you all necessary information to run comparable.

Once you receive this information, you will reach out to the client to explain that you are the local Opendoor real estate professional who will be providing both options, so you can make the best-informed decision on which route you choose to go.

1. Taking the Opendoor cash offer. OR 2 Listing your house on the open market with our 21-day guarantee (WITH NO INCENTIVE). The goal is to give the consumer choice by showing the net number that they will receive by selling to Opendoor OR taking a retail price that you feel comfortable you can sell their home a What we will provide to the consumer? Transparency This is about whatever is best for the client. On the retail side (listing with JMG). We will provide the following:

– 21-day sale guarantee

– Award winning marketing package

– Full service support from our agents

– Real Estate Rewards if purchasing a home. (this is SO IMPORTANT to mention on the call as regardless of what option they choose, we will offer this incentive to the

client.). So even if they choose the OD offer, if they are a buyer we can still assist

them.

Overall Awareness

JMG Mission Control will be making the initial reach out to the client and explaining the program regardless if it is a OD Denial or a Decision Call. It is important that our JMG agents understand the required pitch and process behind receiving a referral. The standard pitch for both programs can be found by clicking here.

-Video synopsis – To review a full program summary of both lead sources, click here

Quick Reference Guides

Opendoor Brochure PDF

Sold.com is a listing referral company who specialize in connect interested sellers to local real estate professionals. Once a consumer inquiry about selling, Sold.com will contact the client to ensure viability. Once the consumer confirms that they are in fact interested in selling, sold.com will connect that client to our concierge team with all necessary information and distribute the client to the according marketplace.

Best Practices

It is important that on the initial call JMG agents cross reference the partnership between sold.com and JMG. We must be sure to follow script (See Scripting Here)

Once you receive a new referral from sold.com an appointment has already been made. Your job is to confirm the appointment and give a quick overview of expectations while building rapport with the client.

JMG agents should foreshadow the process by letting the client know that they are excited to work with them and when listing with JMG you will receive our award-winning marketing package which was just sent to them as well as a sold.com benefits package which includes listing your home at a 1% discount which will save them. $________

Every sold.com client will receive a 1% listing discount when listing with JMG. (this is clearly important to discuss). In addition, they will receive our 5 star concierge service and a full service, award winning marketing package.

The Listing – Confirmation and Awareness

On the morning of your listing apt you will receive a notification from JMG Corp. It is VERY important that you print out the listing rewards certificate and bring all necessary listing collateral material to the apt.

Once the apt has been complete, you MUST update the outcome of the appointment within your appointment reminder. This will trigger a call from the sold.com concierge to immediate contact the client and assist you with closing the sale. IT IS VERY IMPORTANT THAT AFTER EVERY LISTING APPOINTMENT THIS IS DONE!

Updating Referrals

Client are to be updated at the following milestones:

Appt confirmed

Appt complete

Listing signed

Under contract

Closed

In addition, like all partners a weekly update by Thursday at 5pm is also required.

Please be sure to have open communication with JMG communications team on all appointments and updates. Your sold.com team is here to help. Allow them to assist in capturing as many clients as possible by keeping them updated on the clients needs and expectations.

AAA Lending services its current AAA members with obtaining loan financing for home purchase. When a member calls to get qualified, the AAA loan officers will inquire if the member currently is working with a real estate professional. In the cases where they are not the AAA Loan Officer will recommend that they are connected with a real estate agent partner in the network. From there, the client will be placed to AAA’s 3rd party network, Moxie. A moxie agent will then verify that the consumer would like to speak with a network realtor then make the connection.

How the program works

Once a client has been connected from the Moxie network to JMG, the client’s information will be sent to a JMG agent indicating that you have a new referral from the AAA program. These clients will have typically been pre-approved with a AAA loan officers for their home purchase financing. Once you have received a new referral from the program it is important that the JMG agent cross reference the loan officer on the file as well as the incentive that the client will be receiving by working with us and AAA lending. By simply being a member of AAA and utilizing a network agent (you) and AAA lending services, they are rewarded.

Mission Control Actions

JMG-MC will serve our agents more as a follow up process to ensure that they did connect with a JMG agent and help get them set up on a custom search portal. JMG-MC will also serve our agents by providing our follow up processes along the way.

JMG agents once assigned a referral will immediately contact the new AAA client and introduce themselves as the real estate professional who will be assisting them. It is important that the JMG agent cross reference both the AAA loan officer and the incentive that the client will receive by being a AAA member.

All referrals thought the program will run through AAA lending company. There are no other lenders associated with this program. It is critical that JMG agents do their part in ensuring that we do everything possible to protect the AAA loan officer and close with them. Should the client be considering outside financing our JMG agents must make this awareness to the AAA loan officer.

Ideal Agent is a national listing referral company. They engage in heavy marketing across the USA to drive sellers to their company. From their Ideal Agent pitches the client that the agents they work with are the Top Agents in the USA as well as incorporating a listing discount to the client. On our end JMG also offers a 21 day guarantee that the home will sell.

Ideal Agent best practices

It is VERY important that the client understand that you are the preferred real estate agent of Ideal Agent. Your job is to provide them with the full client experience in listing their home while they receive a discount in listing service. Even though it is discounted they will still receive a world class real estate experience backed by the #1 team in the USA. We have specific marketing material around this program so make sure you understand the program front to back.

Expectations from the partnership – 90% listing apt ratio – 60% signed listing ratio.

They will receive a listing discount which is highlighted when you receive the referral, the standard fee is 2% on the listing and 2.5% to a buyer’s agent. In addition, if they are also purchasing the client receives 15% of commissions on the buy-side. There is a 21 day guarantee that we will sell the home, this is not an ideal agent guarantee but an added JMG guarantee. So long as we come up with the correct list price we will not put a client into a contract more than 21 days. If the home does not sell by then, hopefully the client is satisfied with you as their agents and still continues to use our services.

Referral Fee

Referral fees for this partnership are 30% on the sell side and 40% on the buy. The increase on the buy side is due to the client being incentivized 15% or the RE Commission when they purchase a home with us.

Agentaccess (lead–updating portal)

Lead Types

Listing referrals. Discounted listing referrals, with full services behind it. It is important to also ask if the buyer will be purchasing as well so we can assist them on this transaction as well.

Lead updating

Ideal Agent sends update links within their emails as a reminder to update at various stages along the life of the referral. Updates are due upon initial contact along with milestone updates on follow-up calls, listing appointments, under contract, etc.

Important note to remember: Zillow Flex has its own back office

The Zillow “FLEX” program is designed around one main goal for Zillow Group; The Client Experience. Consumers who visit the Zillow sites and who inquire about a property will now be placed with “growth partners” who will then be matched with the consumer to ensure the best real estate experience possible. It is the agent partners responsibility from both agent and operations to facilitate this experience to the consumer.

Zillow best practices

It is important to mention to the client that you just received their information from our partners at Zillow and that you are the real estate professional that will be taking care of them.

How the program works

Direct Connect to Agent – Consumers will now be directed to Zillow’s client experience team. This team will gather information on the client and ask a series of questions in regards to the clients’ wants and needs. From there, Zillow’s client experience staff will transfer the client directly to a growth partner agent, (JMG Agents). Zillow’s team will go over the pertinent information including best showing dates and times available for the client.

JMG Ops will determine the routing rules and the best agent fit according to specific criteria. A phone broadcast will then be sent to the grouping of agents who are best fit to service the client.

Tour requests

Tour requests will actually be handled by the JMG client experience team. A tour request will be sent to one of our call center team members. From there, they will verify the client information and schedule a showing on your behalf. A CET member will then call the agent to let them know there is a confirmed appointment and provide the details.

JMG Ops will be notified that you, the agent, have just accepted a new referral from Zillow. From there, we will automatically connect with Zillow’s system and sync the client into CAMP. CAMP will then alert our agents that you have accepted a new lead and a series of intro from both the team and agent level will begin. Agents will receive this lead notification in the same setting that currently occurs and all awareness triggers from Lead Source, Incentives, Lender and Title will be included with the distribution sent to agents.

Incentives

There is currently a $1500 consumer incentive IF, and only IF, the client utilizes our partners at Zillow Home Loans (ZHL). It is your responsibility as an agent of the program to direct consumers to ZHL and explaining to the client that by working with ZHL you will have a seamless experience as well as being reward. This must be discussed on the initial call. Send the client to ZHL by simply submitting their information in the ZHL pre qual request form; which is also located in the JMG Zillow Back office https://jmgbackoffice.com/zillow-flex/

Agentaccess (lead-updating portal)

All lead updating is to be done on the Zillow Premier Agent App. For awareness on when to update leads see the JMG Zillow Back Office.

ZIllow portal training video

JMG Partners

These partnerships are the foundation of JMG. With these Partnerships, we not only receive Quality Referrals, but we also do our best to give back through Lending and Closing Services. The following information in this section will be primarily on the importance of giving back and how to. Additionally, you will be able to search who your partners are and their contact information.

What truly sets JMG apart from all other Brokerages?

It’s how we give back to those who support us. The Jason Mitchell Group is considered to be the #1 Real Estate partner of many companies for that exact reason, these companies include power partners such as Quicken Loans, New American Funding, Cardinal Financial, Fairway Mortgage, Axos Bank, Amrock, Zillow Closing Services & Realworks. We call the action of giving back “Eating from Your Own Dog Food”.

Why do we call it, “Eating from Your Own Dog Food?”

It goes back to what we said, we are giving back to those who support us. You can not find the amount of Quality and Abundance of referrals from any other company than JMG, and IT’S ALL BECAUSE OF OUR PARTNERS. We never want to be considered the partners just takes what they get and doesn’t hold up their end, we live by giving back to them by sending our self-gen and fall out to our preferred loan officers & or by utilizing our preferred closings services.

Any time you send a referral or self-gen clients to our partners we consider those to be “Dog Bones”. This is something that is tracked on a daily basis and CRITICAL to what we do at JMG. It’s important to note that to be sure your referrals to our partners count as “Dog Bones”, they must be submitted through the “Pre-Qual & Refi Form”.

Speed to Lead is Important for our Lenders as well! Even though we require the “Pre-Qual” form to be submitted when you have a referral for our lenders, you are more than welcome to share the client information with them beforehand to get in touch sooner.

We take utilizing our partnerships seriously. If you haven’t noticed! 🙂 With that said, JMG Monitors Closing Service Capture Rate. and Referral to Dog Bone Ratio constantly.

Closing Services

This rate may fluctuate a little bit market to market but overall, your goal should be to get 50% of closings to utilize our closing service partner. Again, we understand that certain marketplaces may be easier to capture than others, but remember to be creative with this! IF there is a will there is always a way! 🙂

Lending Partners

With our lending partners, our goal is to send on average, 2 for every 10 referrals you received. to them for every 5 that are sent to you. Keep in mind that you are able to be creative with these as well! You can always send 1 client to multiple partners and it will be counted as 2-3 bones, so long as the client understands and is ready to be contacted by them. Additionally, to our lenders, refi referrals to them are just as good as purchase! Be sure to send these through the Pre-Qual & Refi Form in the Back Office.

My Lending Partners

- Our Partners

- Quick notes

- Quicken Loans

- New American Funding

- Zillow Home Loans

- Celebrity Home Loans

- Veterans United

- Axos Bank

JMG Preferred Lending Partners

Due to our strong relationship, each of our lending partners has a dedicated team Exclusively for Jason Mitchell Group Salespeople. The loan officers that are designated for us were chosen by their sales team managers by being the TOP Loan Officers within their company.

As you were onboarded to JMG you were paired with 2 Preferred Lenders. One being a “Preferred Traditional Lender” the other being a “Preferred Non-Traditional” Lender. Neither one of these are Preferred to Utilize more than the other.

Preferred Traditional Lender (Group A)

Preferred Traditional Lenders are typically better suited to Qualify a Traditional Client, one that you may consider to be a “More Established Buyer” with higher credit and stable income.

Preferred Non-Traditional Lender (Group B)

“Preferred Non-Traditional” lenders will be better suited to handle your “Harder to Qualify” clients, say ones with lower credit scores or unique employment history. These lenders tend to be able to be more flexible with their financing requirements.

Preferred A Lender

Quicken Loans is the largest mortgage lender in the U.S. and is licensed in all 50 states. The lender offers conventional mortgages, adjustable-rate mortgages, Federal Housing Administration loans, U.S. Department of Veterans Affairs loans, U.S. Department of Agriculture loans and jumbo loans, as well as reverse mortgage loans, and re-finances.

Important Note

DO NOT send any financing referrals through Client Central / In House Realty. When referring in this manner, nothing will be recorded. ALL JMG referrals MUST be submitted through the JMG Backoffice.

Incentives

When we refer business to Quicken Loans, QL will incentivize your client with a 1% Rebate on the loan amount as a way to help your clients pay for closing costs & prepaids. This is a big incentive that you will want to bring up to your client, in an effort to save them more money.

Who to contact when you are sending them a referral?

All referrals to JMG Partners must go thought the “Pre-Qual / Refi Request” form in the JMG Backoffice. However, we still do encourage our agents to communicate directly with our Dedicated JMG Loan Officers and Relationship Managers.

Nathan Ricci – Triple Crown Banker

P: (480) 346-0978

E: Nathan@quickenloans.com

Bryan Oczytko – Executive Agent Relationship Manager

P: (480) 305-9833

E: BryanOczytko@quickenloans.com

Rocket Pro App (required)

Get Full Visibility

Manage all your clients in one place and track each client’s loan status in real time. Stay informed on all their activity throughout the process.

More Accurate Approval Amounts

Get insight into each client’s price range in the housing market. Adjust their approval letter amount to ensure they can make an offer that stands out.

Help Clear Roadblocks

Don’t let paperwork hold up the process. Use the document upload tool to send files on your client’s behalf and get to closing faster.

Preferred A Lender

New American Funding is a Direct Mortgage lender, specializing inFannie Mae, Freddie Mac, and Ginnie Mae direct lender, seller, and servicing. New American Funding provides home owners and future homeowners a variety of home financing options at competitive rates.

Important Note

DO NOT send any financing referrals directly to NAF Bankers or through their client portal. ALL referrals we send must be sent through the “Pre-Qual / Refinance” form in the JMG Backoffice.

Incentive

When we refer business to New American Funding, NAF will incentivize your client with a $1,000.00 lender credit as a way to help your clients pay for closing costs & prepaids. This is a big incentive that you will want to bring up to your client, in an effort to save them more money.

Who to contact when you are sending them a referral?

All referrals to JMG Partners must go thought the “Pre-Qual / Refi Request” form in the JMG Backoffice. However, we still do encourage our agents to communicate directly with our dedicated JMG Loan Officers and Relationship Managers.

Preferred A Lender

Zillow Home Loans, LLC fka Mortgage Lenders of America, LLC, is a rapidly growing national provider of online mortgage lending services. They are committed to delivering best-in-class service and local market expertise, with communication and transparency every step of the way. Zillow Home Loans was founded in 2000 as Mortgage Lenders of America, and was acquired in 2018 by Zillow Group, which houses a portfolio of the largest and most vibrant real estate and home-related brands on the web and mobile. At Zillow Home Loans, we’re dedicated to using Zillow’s home-buying expertise and cutting-edge technology to offer home buyers a seamless and streamlined mortgage process.

For client to receive incentive, the referral must be sent through the “Pre-Qual / Refinance” form in the JMG Backoffice.

When we refer business to Zillow Home Loans, ZHL will incentivize your client a $1,500.00 lending credit as a way to help your clients pay for closing costs & prepaids. This is a big incentive that you will want to bring up to your client, in an effort to save them more money.

Who to contact when you are sending them a referral?

All referrals to JMG Partners must go through the “Pre-Qual / Refi Request ” form in the backoffice. However, we still do encourage our agents to communicate directly with our Dedicated JMG Loan Officers and Relationship Managers.

Stephen Black – Mortgage Origination Manager

P: (206) 757-6809

E: stephenb@zillowhomeloans.com

Kaelin Avedisian – Mortgage Loan Originator

P: (231) 690-2117

E: kaeling@zillowhomeloans.com

Patrick Simon – Mortgage Loan Originator

P: (949) 842-5969

E: patricksi@zillowhomeloans.com

Preferred B Lender

Celebrity Home Loans is a nationwide direct mortgage lender that provides modernized home financing solutions. CHL is considered an “approved lender” for Fannie Mae, Freddie Mac, and Ginnie Mae as well as an “approved lending institution” for the FHA, VA, and USDA. Not only has Celebrity Home Loans earned all of these approvals, but we have consistently maintained the high standards required by them.

For client to receive incentive, the referral must be sent through the “Pre-Qual / Refinance” form in the JMG Backoffice.

When we refer business to Celebrity Home Loans, they will incentivize your client with a $1,000.00 lender credit as a way to help your clients pay for closing costs & prepaids. This is a big incentive that you will want to bring up to your client, in an effort to save them more money.

Who to contact when you are sending them a referral?

All referrals to JMG Partners must go thought the “Pre-Qual / Refi Request” form in the JMG Backoffice. However, we still do encourage our agents to communicate directly with our Dedicated JMG Loan Officers and Relationship Managers.

Avalon Altamirano – Business Development Specialist

Chris Makiri – Branch Manager * if in any other state

Veterans United Home Loans is a full service mortgage lender headquartered in Columbia, Missouri. The company has 28 offices nationwide and is licensed in all 50 states. The company primarily originates VA loans, a mortgage product guaranteed by the U.S. Department of Veterans Affairs.

For client to receive incentive, the referral must be sent through the “Pre-Qual / Refinance” form in the JMG Backoffice.

When we refer business to Veterans United, they will will incentivize your client FREE appraisal ($795.00 Value) as a way to help your clients pay for closing costs & prepaids. This is a big incentive that you will want to bring up to your client, in an effort to save them more money.

Who to contact when you are sending them a referral?

All referrals to JMG Partners must go through the “Pre-Qual / Refi Request ” form in the backoffice. However, we still do encourage our agents to communicate directly with our dedicated JMG Loan Officers and Relationship Managers.

Mike Mange – Senior Mortgage Loan Officer

P: (800) 814-1103 x 3381

E: mmange@vu.com

Josh Kaplan – Senior Mortgage Loan Officer

P: (800) 814-1103 x 3401

E: josh.kaplan@vu.com

Preferred B Lender

Axos Bank is an American federally chartered direct bank headquartered in San Diego, California. It is the main consumer brand of Axos Financial. They specialize in low mortgage rates and products optimized for your needs. In addition to a $0 lender fee, your clients can earn 3% annualized cash back** through their Total Loan Rewards Checking Account.

When we refer business to Axos Bank, Axos will incentivize your client FREE loan (waived lender fee) as a way to help your clients pay for closing costs & prepaids. This is a big incentive that you will want to bring up to your client, in an effort to save them more money.

For client to receive incentive, the referral must be sent through the “Pre-Qual / Refinance” form in the JMG Backoffice.

Who to contact when you are sending them a referral?

All referrals to JMG Partners must go through the “Pre-Qual / Refi Request ” form in the back office. However, we still do encourage our agents to communicate directly with our dedicated JMG Loan Officers and Relationship Managers.

John Dustman – Senior Vice President, Consumer Direct Lending

P: (858) 649-2001

E: jdustman@axosbank.com

Shannon Shanks – Mortgage Consultant

P: (616) 530-5968

E: sshanks@axosbank.com

My Closing Services

JMG Preferred Closing Services

Title & Escrow

We also have dedicated Closing Services teams for JMG. These partnerships are just as important as any, and require great communication on both ends.

Every Agent on our Team is assigned a Preferred Closing Partner for Title and Escrow services.. These partnerships are generally based on geo location, unless we have multiple partnerships in one single location. Utilizing these services on EVERY file is a critical component of being a part of JMG.

IF IN ARIZONA

You are to Utilize Realworks Title & Escrow for ALL Transactions.

Exception: If your client is a IHR/Quick Loans Referral, where you are to utilize Amrock or If your client is a Zillow Flex Referral, Where you are to utilize Zillow closing services.

All other markets

Your Preferred Closing Services are Amrock

.

Capture Rate

We take utilizing our partnerships seriously.. If you haven’t noticed! 🙂 With that said, JMG Monitors Closing Service Capture Rate. This rate may fluctuate a little bit market to market but overall, your goal should be to get 50% minimum of closings to utilize our closing service partner.

Closing Services (AZ ONLY IF ZILLOW REFERRAL)

Zillow Closing Services Consultation Management Services in Settlement Services, Purchase Mortgage Originations and Servicing, Brokerage Technology and Data solutions. Their focus is on providing you a faster and smoother closing experience. Their team has experience completing thousands of title and escrow transactions, and will close on a date that works best for you and work to make it as easy and convenient as possible. Their goal is to be sure you’re informed throughout the closing process so that you can rest assured everything is being covered.

when should I use Zillow Closing Services?

Reiterating a common ISIM in this section is to “Always Honor the Source”. Our expectation is that if you are working a Zillow FLEX referral you are utilizing ZCS for all your closing services, being that Zillow Closing Services is within the FOC of Zillow Group.

how do I open a policy with Zillow Closing services?

To open a policy with ZCS, simply complete the “New Escrow Form” in CAMP. When you complete this, Jodi & her team will be notified to begin opening up a Policy for you.

who to contact

Jodi Terry – Escrow Officer

Closings-AZ@zillowclosings.com | zillowclosings.com

(833) 927-1602 direct | (833) 927-1616 office

4343 N. Scottsdale Rd. Suite 390 | Scottsdale AZ 85251

Always honor the source! All Markets preferred title (exception – AZ)

Amrock is a part of Rock Ventures’ FOC (Family of Companies) they are the nation’s largest independent company offering title insurance, property valuations and closing services. Amrock touches all areas in title insurance, valuations, and closing services nationwide. With custom technology, deep expertise, and a dedicated team, they offer individualized solutions based on your needs

When should I use Amrock?

This question is 2 fold and depends on 2 very important factors. If either of these factors are true, you should be sending your files to Amrock for their services.

Factor 1: is this a referral from Quicken Loans?

If the answer to this question is Yes, then this is resounding YES and at all costs we want to give back to Amrock. The reason for that goes back to our ISIM of “Always Honor the Source”. With Amrock being a part of the Quicken Loans FOC we need to be sure we are keeping their referrals in their ecosystem of RE / Finance & Title companies at all costs.

Factor 2: Are you in a marketplace outside of Arizona?

If the answer to this question is Yes, then Amrock is your preferred Closing Services for all transactions.

who to contact

Amber Chamberlain – Account Manager

AmberChamberlain@amrock.com | amrock.com

(313) 338-0538 direct | (855) 455-6685 direct fax

1187 Thorn Run Rd., Suite 600 | Coraopolis, PA 15108

RealWorks currently provides settlement, consulting & investment services in Southern California and Title and Escrow services in Arizona. In addition, RealWorks provides Consultation Management Services in Settlement Services, Purchase Mortgage Originations and Servicing, Brokerage Technology and Data solutions. RealWorks also provides investment and investment guidance on residential real estate related endeavors. They focus on providing a customized service experience to each home buyer and seller they serve. JMG has a dedicated team that engages in each transaction as a unique and singular event that provides focus and individual attention to all parties to the transaction.

When should I use Realworks?

As of now, this question is very simple, if you are an Arizona Sales Agent, This is your Title Company for ANY & ALL transactions. There is 1 exception, and that would be if your transaction is from a Quicken Loans referral, where we would “Honor the Source” and send it to Amrock.

How do I open a policy at Realworks?

To open a policy with RealWorks, simply complete the “New Escrow Form” in CAMP. When you complete this, Sheri & her team will be notified to begin opening up a Policy for you.

who to contact

Sheri Alverson – Escrow Officer

sheri.alverson@realworkscorp.com | realworkscorp.com

(626) 390-3422 direct | (602) 626-3661 direct fax

7702 E. Doubletree Ranch Rd #300 | Scottsdale AZ 85258

RELO

In order to create and maintain healthy and advantageous relationships with Relocation Providers, we must understand and share the philosophy that we are here to make the relocating employee and family’s transition from the old location to the new location as smooth, seamless and stress free as possible. The more seamless our transactions are with the relocating employees, the happier our relocation providers are with us. This is a customized training for agents who will be handling these types of transactions will be required so they too can share the philosophy stated above.

A Day in the Life of Relocation

- Employee signs contract with employer for new job in a new location

- Employer authorizes relocation benefits with their relocation provider

- Relocation provider plays key role in administering benefits to relocating employee

- Services administered by relocation provider:

- Homefinding trip (flights, hotel, transportation, meals, realtor)

- Lump sum, or miscellaneous allowances to help offset costs not included in benefit package

- Home Sale: relocation provider provides two or more realtors (from different brokerages) for relocating employee to choose from to list their home and guide them through the home selling process

- Home Purchase: Relocation Provider coordinates relocating employee with realtor in the new location to meet them during their home finding trip. Realtor takes it from there to assist employee in finding a home, offer to close

- Lender referrals

- Temporary Living Accommodations: relocating employee and family to live in temporary quarters in the new location until they close on their new home

- Transportation of Household Goods and Storage. Vehicle shipment, Pet shipment

Home Sale

- Guaranteed Home Sale – safety net offer provided by the relocation provider to relocating employee if they are unable to procure sell on their home within the allotted time per their relocation benefit package. Tax exempt

- Buyer Value Option – Relocating employee obtains bona fide offer at which point the relocation provider takes over the sale. Tax Exempt

- Independent Sale- Relocating employee obtains offer, closes on their own, and relocation provider reimburses for allowable closing costs (realtor’s commission, ect.). Taxable

- Referral fees range from 37%-41% on home sale transactions and are paid to the relocation provider at the time of closing

Three–Party Home Sale

The benefit of a third party home sale program is it is a tax exempt transaction for the homeowner (relocating employee) in the eyes of the IRS. IRS Ruling 2005-74

Flow:

- Homeowner receives and verbally accepts offer that is deemed bona fide

- Offer is written with the relocation company as the seller

- Relocation company writes an offer to the homeowner mirroring the terms of the outside offer

- Homeowner signs the contract with the relocation company

- Relocation company countersigns offer with relocating employee

- Relocation company signs the offer with the outside buyer

- Relocation company “closes” with homeowner and works with the outside buyer through closing

Home Purchase

- If relocating employee is authorized for new home purchase benefits, this means that a certain percentage of their closing costs will be covered/paid for by the relocation provider on behalf of the employer

- Realtor recommendation is made as quickly as possible and in time for relocating employee’s home finding trip. Realtor’s responsibility from that point to is to assist relocating employee in finding a home, closing on the home and other white glove services

- Realtor will be notified upfront by the relocation provider if lender connection has been made so there are no duplicated efforts or undue competition, and realtor and lender can liaise accordingly throughout the transaction

- Referral fees range between 37% and 40% on average

Group Moves

Offer a full scope of services for Group Moves:

Home purchase assistance

Rental assistance

Fam Trips

Area tours

Our U.S. domestic clients turn to us for assistance when moving employees state-to-state or across the country. We listen to what they need and design exceptional domestic programs from the services we’ve detailed below. Aside from being top-notch listeners, we’re experts on policy review and design, best-in-class practices, identifying your biggest challenges and most unique problems, and working with you to develop inventive and intelligent solutions.

Home Marketing

A home that isn’t selling increases the cost of temporary housing, storage, and return trips home and is a difficult distraction for the employee. Our Home Marketing Service is free to employees and corporate clients, and the employee can retain choice and flexibility after they are paired with a qualified, relocation-trained real estate agent. Our team then manages the agent, ensuring a proactive marketing plan is developed.

Home Sale Programs and Assistance

If you find your new hires and transferring employees need to sell their homes quickly, ask us about the assistance we can offer through trustworthy, professional real estate brokers. We share your goal of home sale at the highest possible price, as quickly as possible for your employees. Home Sale Programs include Buyer Value Option (BVO), Guaranteed Buyout (GBO), and Amended Value Sale (AVS).

Destination Home Purchase

Our personal approach to relocation as your employees’ consultant, advocate, and liaison helps them determine and rank priorities in their home search so they can quickly clarify which properties are most suitable, shortening the search process. We pre-screen real estate agents, set up tours of the new location and amenities, arrange home previews, and provide professional advice during the offer, negotiation, and home purchase process for employees.

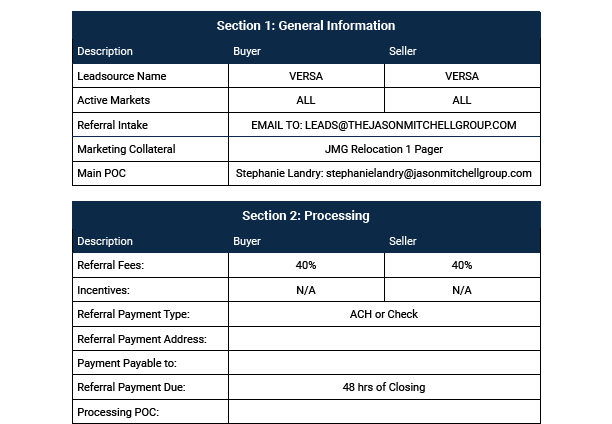

VERSA Matrix

The cost of talent mobility is on the rise for North America Relocation. Global Mobility Solutions drives organizational cost down without sacrificing quality service or employee satisfaction through the use of its many robust and customizable domestic relocation services.

One of the reasons HRO Today rated GMS at the top of the relocation industry is that our North America relocation services are designed to exceed industry best practices and tailored to fit your organizational goals. Our domestic relocation solutions are customized to meet your unique corporate needs.

Global Mobility Solutions employs the most tenured talent in the relocation management industry. 100% of the coaches who guide transferees through the relocation process are industry certified.

Regardless of your company’s size or volume, GMS will partner with you to customize a relocation program that is flexible, cost-effective, and able to make managing your mobile workforce easier.

GMS' 5 Pillars of Success

- Alignment & Reach

- Global Technology

- World Class Partner Network

- Single Point of Coordination

- Dedicated Account Management and Mobility Consulting

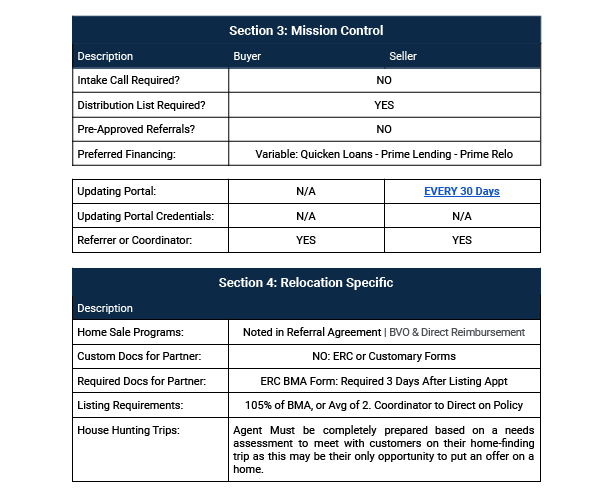

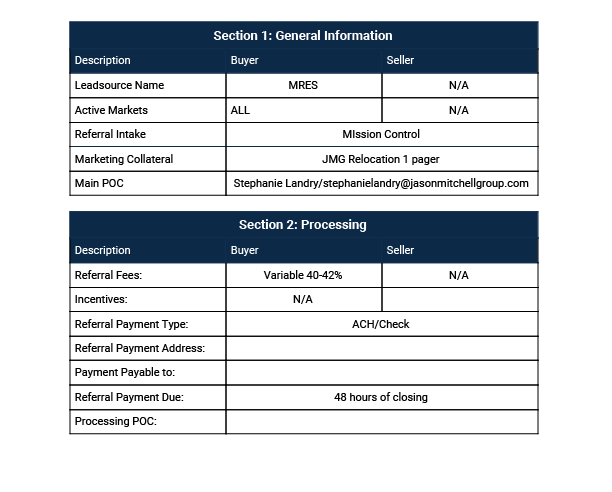

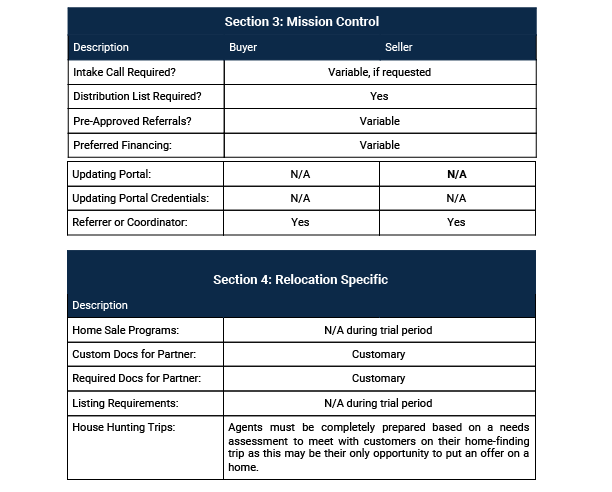

GMS Matrix

Morreale Real Estate Services, Inc. is an independent, family owned company that provides services to the real estate, mortgage, and corporate relocation industries. MRES manages various relocation company’s broker network. So, while the referral will be from MRES, it will actually be for a relocating employee being moved by a different relocation company.

Background of MRES

Morreale Real Estate Services, Inc. is part of the Morreale Family of Companies. With over 45 years of relocation experience, Morreale Real Estate focuses on servicing our clients first. From our humble beginnings as a law firm, Morreale Real Estate now handles relocations throughout the United States, Canada, US Virgin Islands, and Puerto Rico.

John F. Morreale is Chairman and John C. Morreale is President of Morreale Real Estate. With their combined leadership and the addition of very experienced staff, we provide our clients with customized solutions tailored to their specific needs.

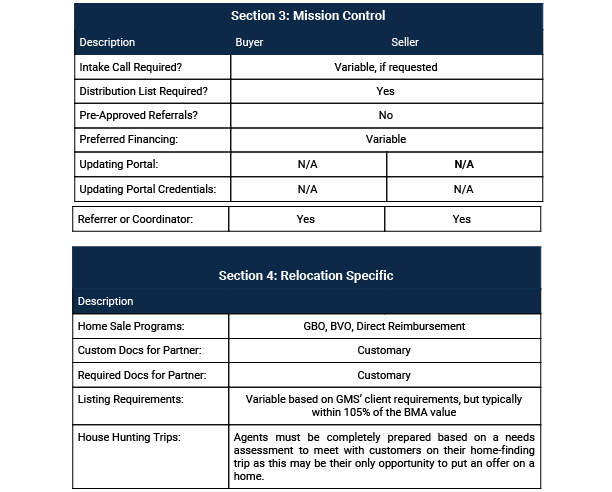

MRES Matrix

Click on the links below to download: